utah state solar tax credit

Codes for Apportionable Nonrefundable Credits TC-40A Part 3. There is no tax credit on solar panels that you purchase and then sell to someone else.

Solar Incentives In Utah Utah Energy Hub

A Secure Online Service from Utahgov.

. You can receive a maximum of 1000 credit for your purchase. Fill out the rest of the form as you normally would when filing your state taxes. Dolla dolla bill yall.

Utah Solar Tax Credit Expiration Changes. Alternative Energy Development Incentive. From 2018 to 2021 the maximum credit available for residential solar PV is 25 of eligible costs or 1600 whichever is lower.

Renewable energy systems tax credit. The individual income tax credit for residential systems is 25 of the reasonable installed system costs up to a maximum credit of 2000 per residential unit. Find The Best Solar Providers Servicing Your Area See 6489 Reviews Now.

Until December 21 2020 this tax credit covers the lesser of 25 percent or 1600 of any residential solar panel array. 20 Utah my529 Credit formerly UESP. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings.

State Low-income Housing Tax Credit Allocation Certification. The Utah residential solar tax credit is also phasing down. Everyone in Utah is eligible to take a personal tax credit when installing solar panels.

18 Retirement Credit. How does the Utah tax credit for solar panels work. If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs.

350 North State Suite 320 PO Box 145115 Salt Lake City Utah 84114 Telephone. Utahgov Checkout Product Detail. Add the amounts and carry the total to TC-40 line 24.

Qualifying for the Utah Solar Tax Credit. Ad Get Solar Power For Your Home. Compare Quotes Online Today.

According to the Utah State Tax Commission httpincometaxutahgovcreditsrenewable-energy-systems You can get Form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification. File with your state taxes. Learn more and apply here.

Utah customers may also qualify for a state tax credit in addition to the federal credit. 2000 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit. Theres no cap on the federal tax credit and youll deduct that after you subtract your rebate.

The Utah credit is calculated at 25 of the eligible cost of the system or 1600 whichever amount is less. This credit is for reasonable costs including installation of a residential energy system that supplies energy to a Utah residential unit. Renewable Energy Systems Tax Credit Application Fee.

Your Cart Your Cart. The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects capped at 1600 whichever is less. To apply for the TC-40e form go to.

04 Capital Gain Transactions Credit. Taxpayers wishing to use this tax credit must first apply through the Utah State Energy Program before claiming the tax credit against their Utah state taxes. This form is provided by the Utah Housing Corporation if you qualify.

Renewable Energy Systems Tax Credit. This form is provided by the Office of Energy Development if you qualify. The Utah credit is calculated at 25 of the eligible cost of the system or 1200 whichever amount is less.

Energy Systems Installation Tax Credit. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. When customers purchase a system this state tax credit is credited toward Utah state taxes owed and deducted from the solar costs.

Application fee for RESTC. The 2018 Utah Legislature passed HB 293 lowering the state individual income. Write the code and amount of each apportionable nonrefundable credit in Part 3.

Utah has a state tax credit for solar. Additional residential energy systems or parts may be claimed in following years as long as the total amount claimed does not exceed certain limits. The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum of 1600.

The Utah tax credit for solar panels must be used within 3 years of the purchase date of the solar panels. And of course Utahns also benefit from the Federal Solar Tax Credit. All of our customers qualify for the US.

Utahs solar tax credit makes going solar easy. High Cost Infrastructure Tax Credit. 2018 Utah Legislature passed HB 2003 creating a Utah personal exemption for dependents that qualify for the child tax credit on a fi lers federal return.

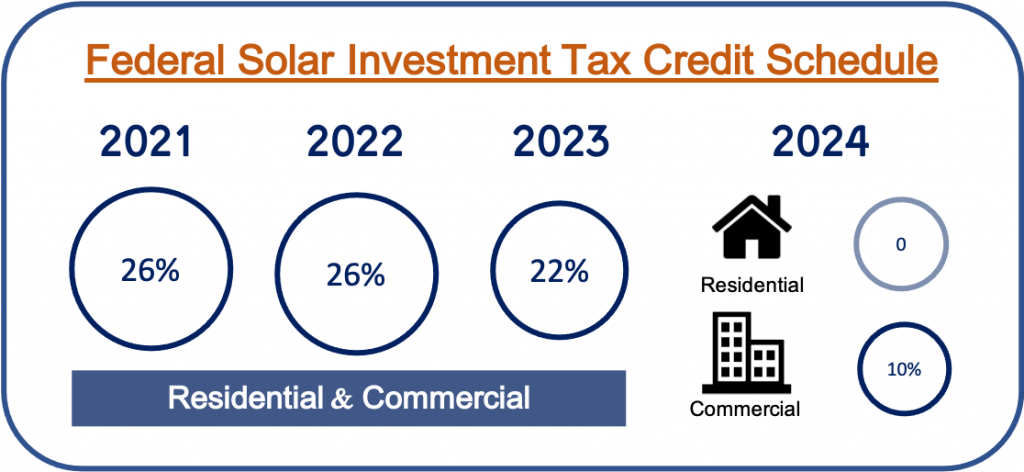

Federal tax credit its technically called the Investment Tax CreditUtah customers qualify for a state tax credit in addition to the federal credit. You can apply for the Utah solar tax credit yourself or ask your solar installer to gather and complete the necessary steps. Starting in 2021 it will resume its yearly phase down until this tax credit reaches zero at the end of 2023.

Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. All of our customers with a taxable income qualify for the US. QUALIFYING FOR THE UTAH SOLAR TAX CREDIT.

Attach TC-40A to your Utah return. Utahs solar tax credit currently is frozen at 1600 but it wont be for long. Utah Tax Rate.

The Utah tax credit for solar panels is 20 of the initial purchase price. Utah State Energy Tax Credits Utah offers state solar tax credits -- 25 of the purchase and installation costs of a solar system -- up to a maximum of 2000. Where do I enter the information to receive the Utah state tax credit for solar.

Federal tax credit its technically called the Investment Tax Credit. This amount decreases by 400 each year after until it expires. Utah solar customers would be wise to invest in solar before the available funding is no longer within their reach.

Sunedison Principal Partners Of Fkcci Green Summit 2015 Solar Material Solar News Solar

Renewables Account For Most New U S Electricity Generating Capacity In 2021 Today In Energy U S Energy Informa Electricity Solar Power Batteries New Uses

Preventive Solar Of Utah 801 602 8040 Solar Energy Http Www Preventivesolarutah Com Solar Energy Green Life Solar

Reasons Why You Should Have Solar Roofing Infographic Educational Infographic Renewable Sources Of Energy Infographic

Solar Investment Tax Credit Itc At 26 Extended For Two Years Creative Energies Solar Solar Design Residential Solar Passive Solar Design

Solar Incentive Drop In Delaware As Demand Increases Solar Energy Diy Solar Energy For Home Solar Installation

India Set For 10 Gw Of Agricultural Solar Lắp đặt điện Mặt Trời Khải Minh Tech Http Thesunvn Com Vn 09066 Renewable Energy Projects Solar Agricultural Sector

Can Solar Panels Be Replaced With The World S Road Asphalts This Is One Of Them A Solar Panel Lying Under A Road Is At A Number Of Disadvantages As It S Not

Preventive Solar Denver 720 646 6677 Address 7315 S Revere Pkwy 604 Suite C Centennial Co 80112 Http Www Preventivesolardenver Com Utah Solar Green Life

Giga Factories That Power The Planet Elon Musk S Vision For Solar Energy Infographic Solar Energy Diy Renewable Energy Solar Energy

Take Advantage Of Solar Incentives For Small Commercial Installations Solar Solar Power House Solar Installation

Understanding The Utah Solar Tax Credit Ion Solar

Solaria To Install 626 Mw Solar Pv Plant In Guadalajara Spain Solar Solar Pv Solar Companies

Utah Solar Incentives Creative Energies Solar

Solar Resource Data Tools And Maps Solar Map Analysis

Solar Backup Power Like The Tesla Powerall Are Included In Itc Tax Credits Investing Solar Program

Understanding The Utah Solar Tax Credit Ion Solar

Solar Panel History And Creation Renewable Energy Solar Technology Solar